Ei and cpp max 2022 (339 無料画像)

CPP and EI Considerations For Self-Employed Canadians | 2022 TurboTax® Canada Tips.

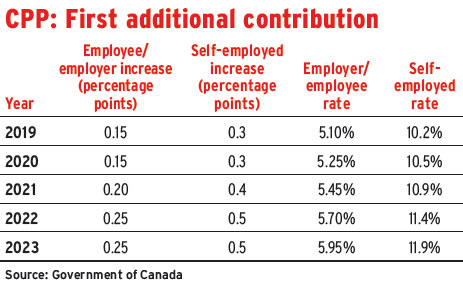

CPP premiums set to rise in January, a bigger jump than planned | CBC News.

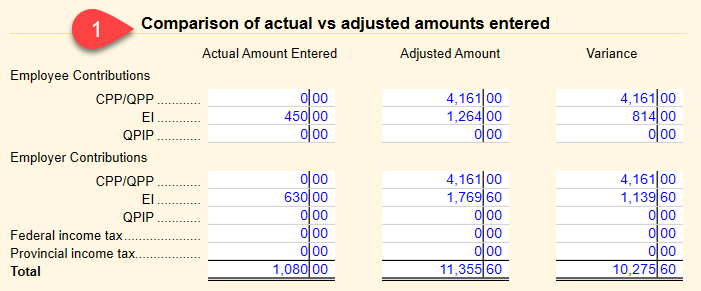

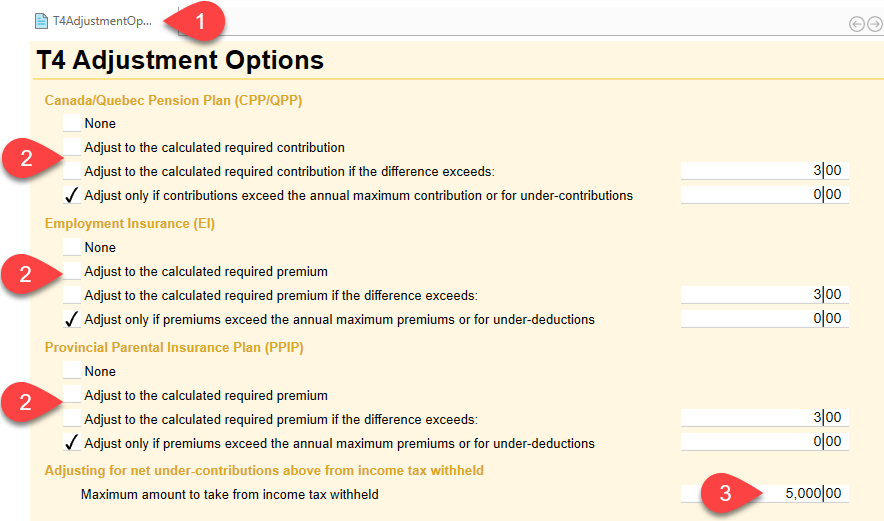

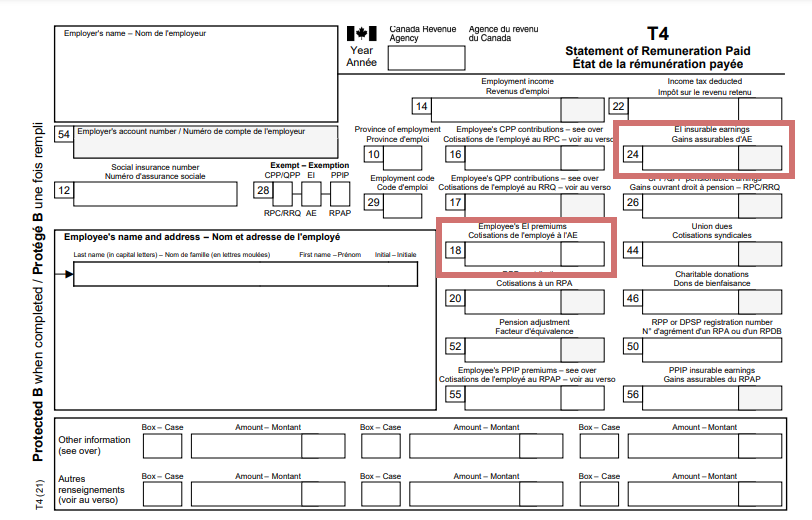

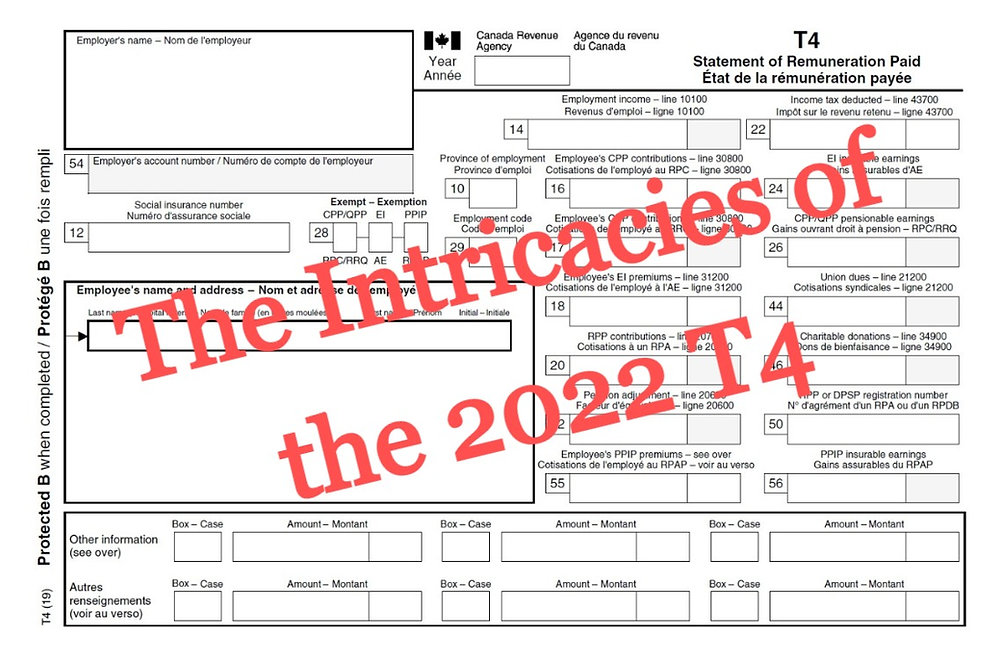

Before you issue T4s: make payroll changes using AgExpert Accounting - AgExpert Blog - FCC AgExpert Community.

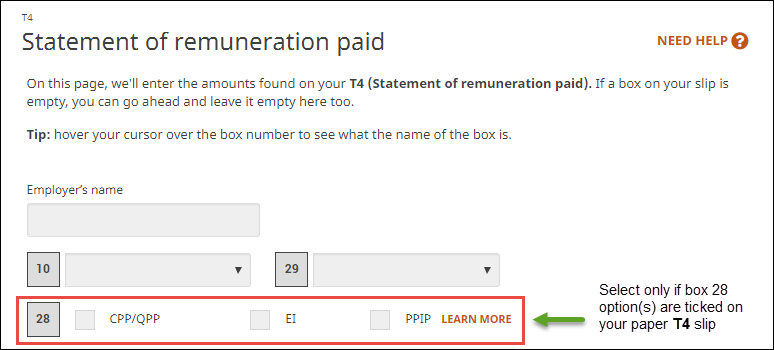

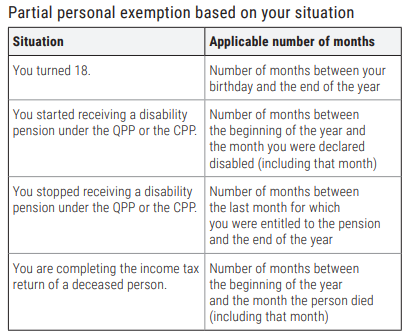

DT Max - Line 248 - Deduction for Québec Pension Plan (QPP) and Canada Pension Plan (CPP) contributions and Québec parental insurance plan (QPIP) premiums.

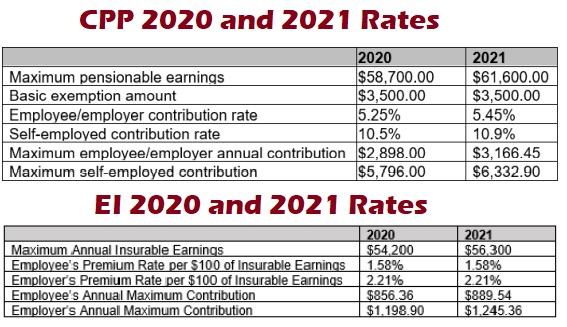

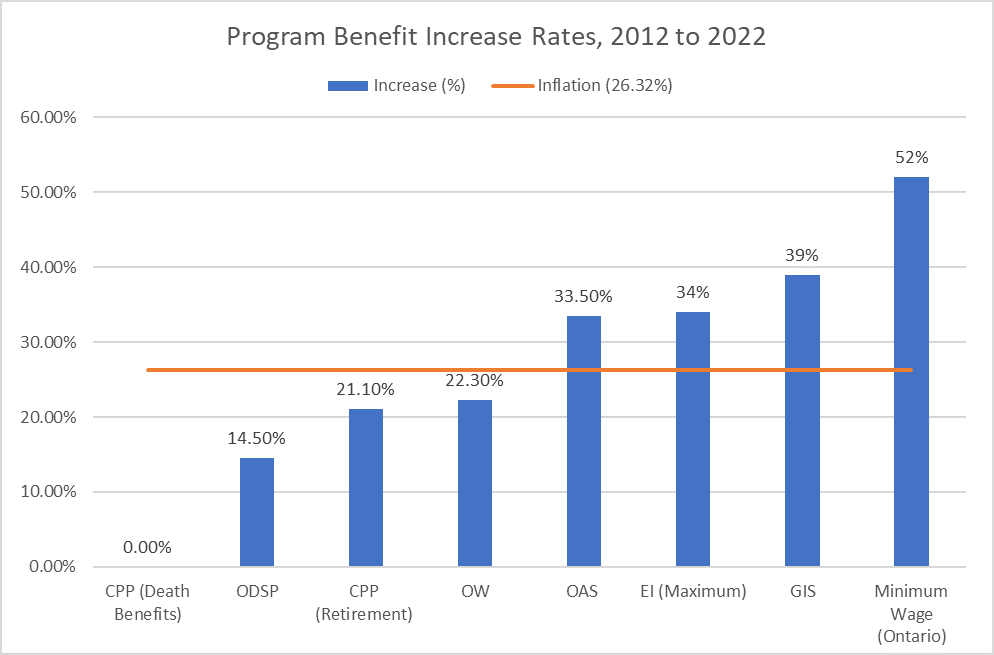

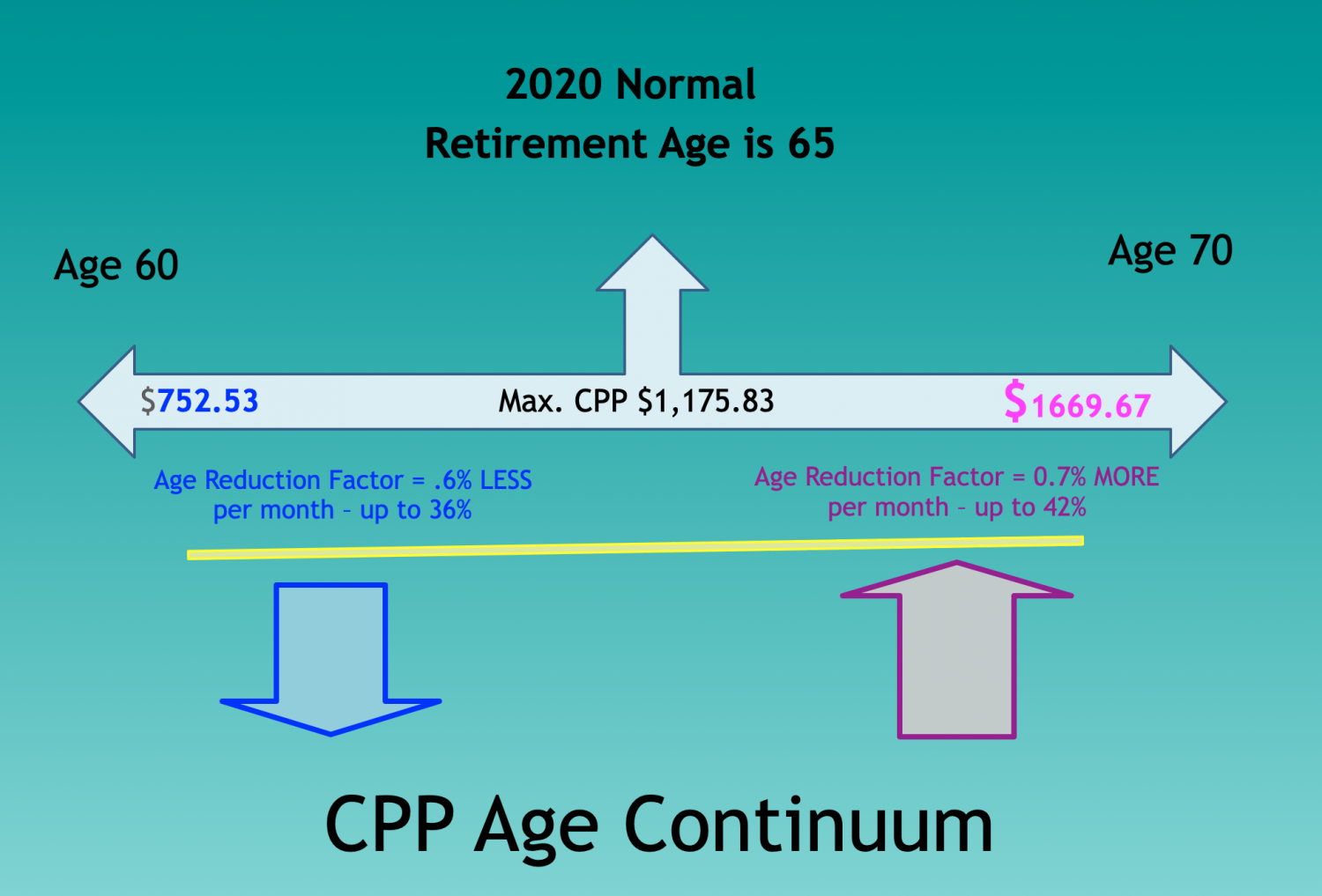

What are the Changes to the 2020 Employment Insurance and Canada Pension Plan Rates?.

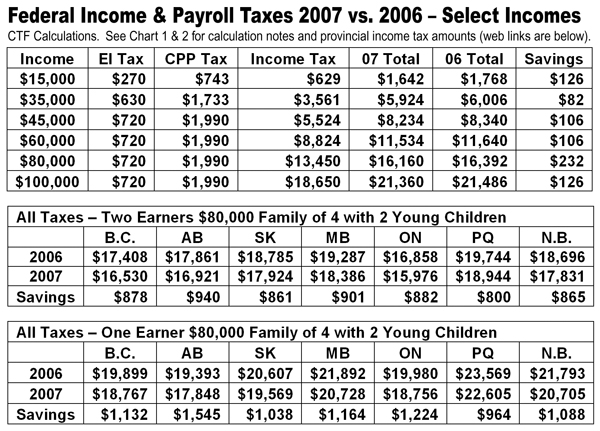

New year, more taxes: Canadians' take-home income to drop by up to $305 on January 1 due to EI, CPP hikes - Weekly Voice.

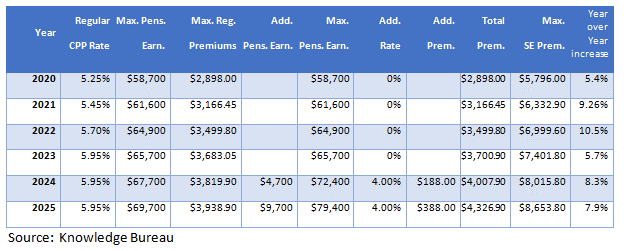

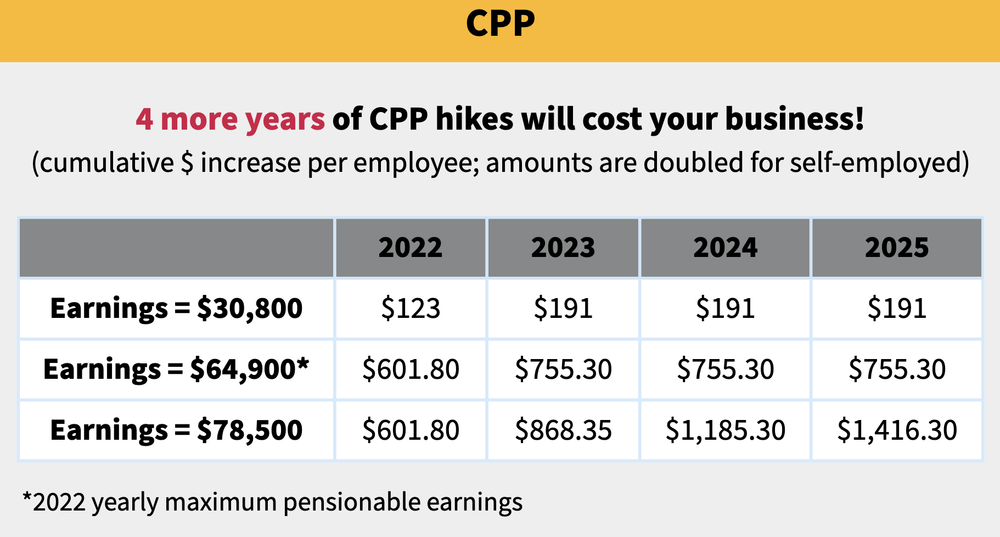

A new year and new hike to CPP premiums— the largest in three decades — to hit Canadians | National Post.

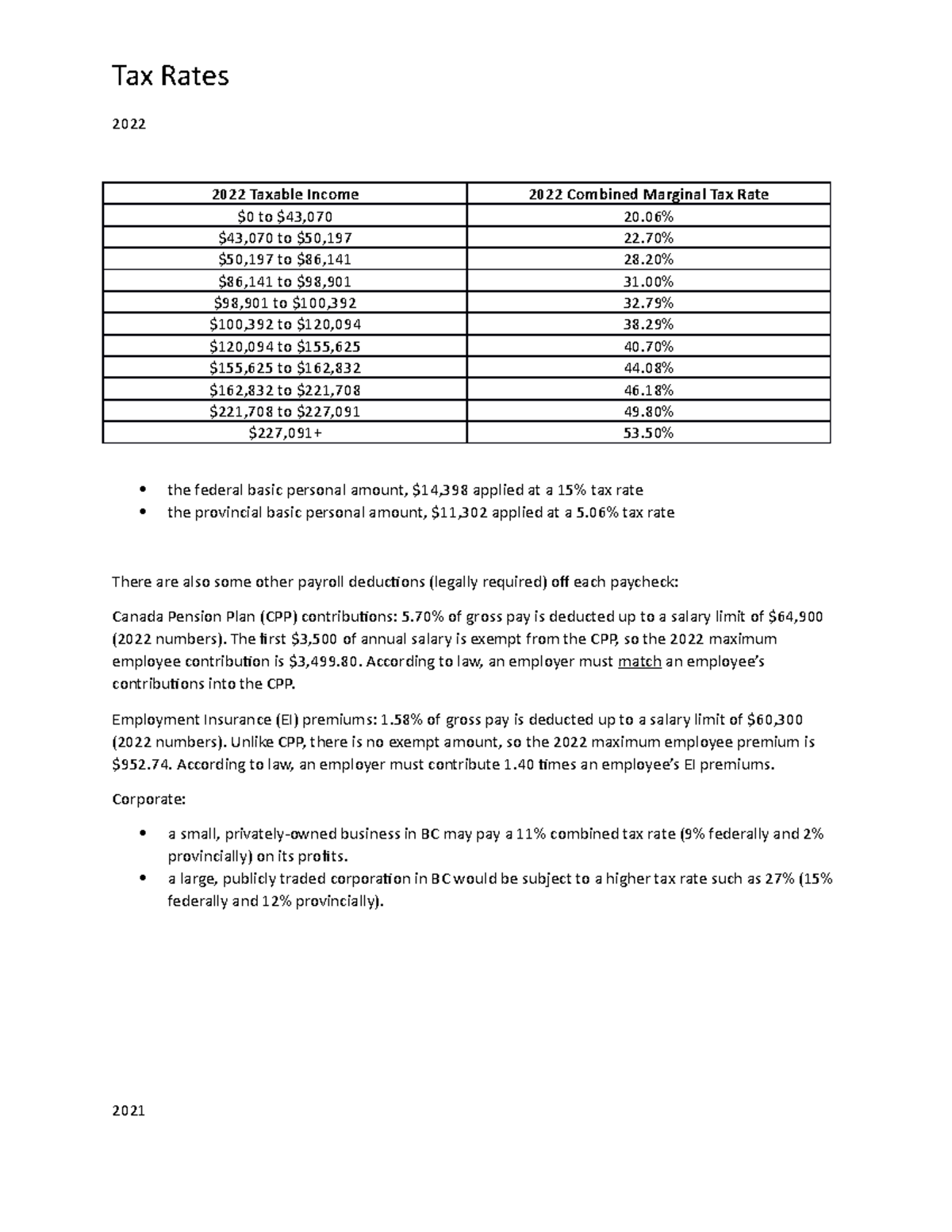

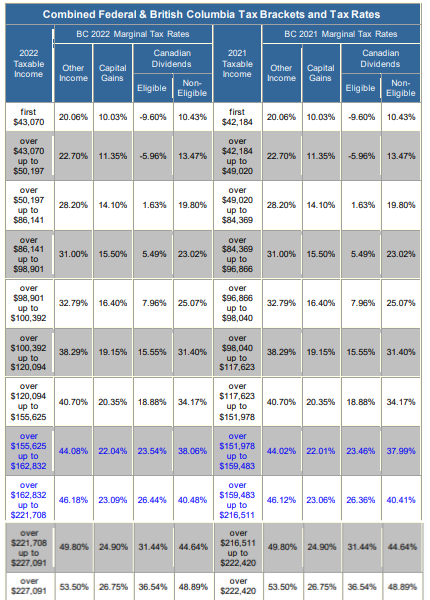

T4032-MB, Payroll Deductions Tables – CPP, EI, and income tax deductions – Manitoba Effective January 1, 2022.

CRA wins tax case dealing with restaurant servers' electronic tips | Financial Post.

Reasons your January 5, 2022 pay will probably be smaller than the last pay in December : r/CanadaPublicServants.

CPP maximum pensionable earnings increasing to $66,600 in 2023 | Benefits Canada.com.

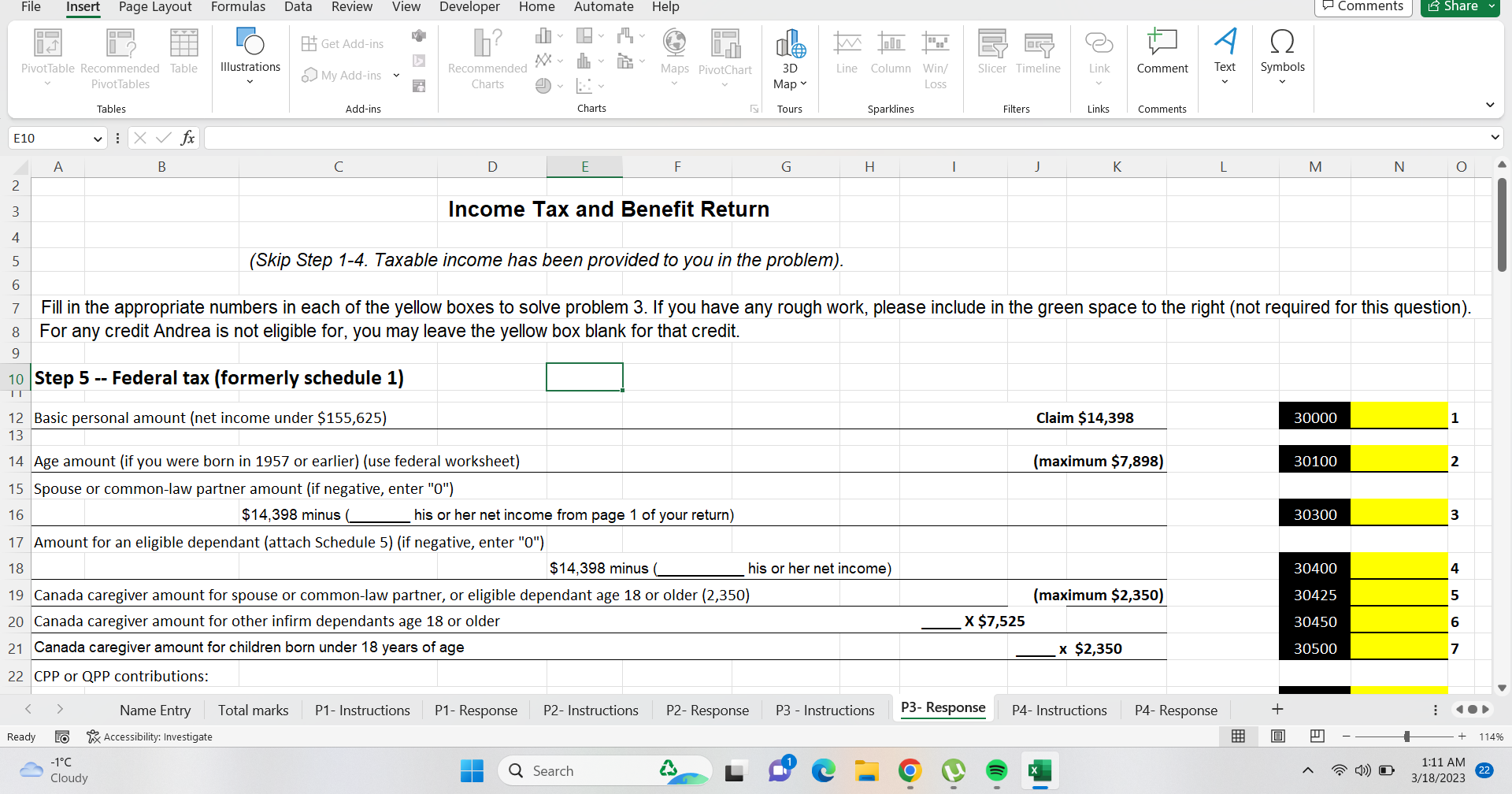

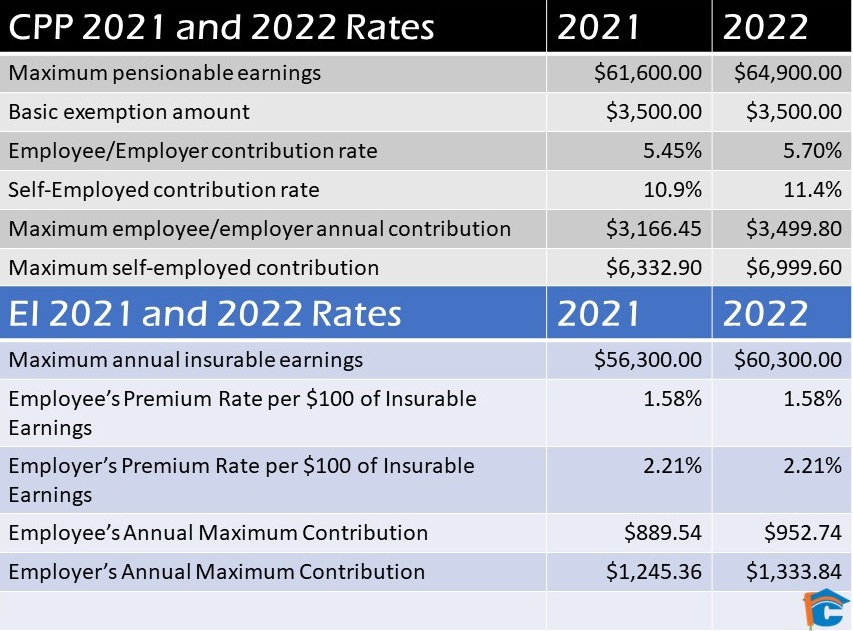

Understanding Payroll Deductions: Personal Income Tax Rates, CPP/QPP, EI and Basic Exemption.

Maximum CPP Premiums to Jump 10.5% in 2022: How You Can Combat it! | The Motley Fool Canada.

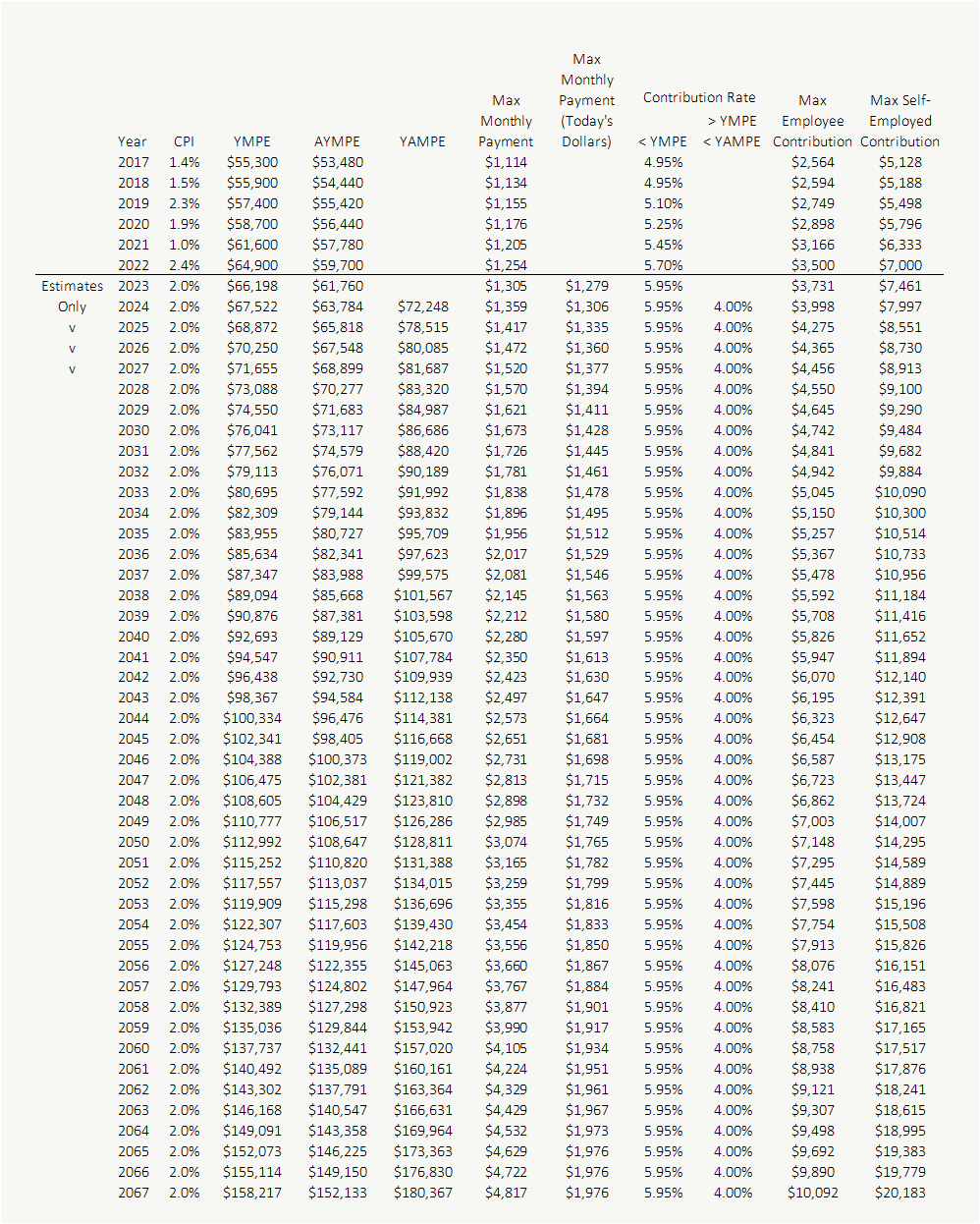

CPP and EI Contributions - Snap Projections - Support 1-888-758-7977 ext. 2 - 9 am to 6 pm ET on weekdays.

CPP and EI Contributions - Snap Projections - Support 1-888-758-7977 ext. 2 - 9 am to 6 pm ET on weekdays.

![Solved] Question 3 Required: Determine the maximum amount of](https://granplus.cl/img/ei-and-cpp-max-2022-8.jpg)